Author’s note:

Crippling reticence almost always overwhelms me when sharing my thoughts on any given subject; because I feel like others will think I’m setting myself up as an authority on the subject, when that couldn’t be farther from the truth! Much prayer goes into the things that I write/say, yet still, I tremble with worry that I’ll say what “I think” or “I believe” as opposed to what God wants. Please, keep in mind that, when I cite a personal example, it is merely that – an example, not a rule book. What God has led us to do in our lives and with our children may not be what He leads you to do with yours. What is important is that His Word always have the preeminence, and I hope that these thoughts point you toward exactly that – the truth and authority of God’s Word, His promises, and His plan.

Giving Children

In contemplating “giving children,” several things come to mind. You see, the word “giving” may be rightly regarded as a verb or as an adjective. But I believe that teaching and encouraging children to be giving must start with the parents themselves GIVING their children to God. Over and over my mother lovingly said to me (and I have, since, said to my children), “I’m glad God gave you to me to raise here on this earth, but you are really HIS.” She would reinforce it with, “I gave you back to Him before you were even born.” While a young child may not understand exactly what that means, he still needs to hear it (if it’s true for you, the parent); and with Biblical training, he will come to know/understand …

– That giving pleases God

– That “pay it forward” and “giving back” (among other ideas) are twisted views of giving

– That giving involves much more than money or things

– That giving should happen every day

– That giving is practical

– What Biblical giving truly is

Giving Pleases God

That seems like such a “duh!” statement, right? Giving pleases God? No kidding! After all, even our modern society approves and enables giving! Where would we be without Kickstarter, GoFundMe, and myriad similar sites that promote crowd-funding? Well … ahem … that’s a debate for another day …

With no censure for the aforementioned organizations, they still hold little worth in proving the principle that giving pleases God. (Please, note, I did not say that they cannot be used in the application of giving that pleases God. More on that later.) A quick search of the Bible and the words associated with giving – such as give, given, giving, gave, offer, offering, etc. – yields a total of at least 2,500 uses. It is possibly much higher, as it’s likely I did not include all possible variants in my search.

What is abundantly clear is that God wants us to understand and teach giving. Giving is, in fact, part of God’s very nature. What compelled Him to create this universe, in all of its mystery, beauty, and impeccable function? As a gift to man! (Gen. 1:17, 29) Even after Adam’s disobedience and sin’s curse, God reminds us that what He created was and is a gift to us. (Gen. 9:3) Teaching children God’s attribute of giving from the very start of creation is key to them understanding Who He is and the value He places on giving.

God gave land and goods to His people – Abraham, Isaac, Jacob, the Israelites – at multiple stages in their history.

Throughout His Word, He records stories of men who practiced the right kind of giving and also those who did not.

He called on psalmists and prophets to give of themselves in ways at which we marvel, but He gave them the grace and strength for each day.

And then, the Author of giving gave all of Himself … to me.

When I teach God’s Word and principles to my children, giving is an inescapable theme. So, with this Biblical jumping-off point, what are the best methods and ideas to properly communicate God’s heart of giving?

“Pay It Forward” And “Giving Back” (among other ideas) Are Twisted Philosophies of Giving

There are many, many giving ideologies that have been promoted throughout the ages. While contemplating this article, I began examining some of the more recent ones – not that the ideas are recent, but rather, the catchphrases and descriptions associated with them have been modernized. There is the “pay it forward” ideology, from the book and movie of the same name. Another ideology is found in the seemingly self-explanatory catchphrase “give back.” In an effort to reach the up-and-coming generations, well-known children’s books or long-standing fables, such as The Giving Tree, The Rainbow Fish, and The Lion and the Mouse have been published on the subject of giving.

You may wonder why I lump all of these ideas into “twisted views of giving.” Perhaps one of the books or movies mentioned are among those nearest and dearest to your heart. It is not my intent to desecrate your favorite take on giving but rather, as stated earlier, to point my own heart and yours to the truth of God’s Word. If we claim to accept His Word as absolute truth, then everything else must be measured by and compared to It.

Whether or not you’ve read the book or seen the movie (I haven’t), the “pay it forward” philosophy is fairly well-known and is essentially a chain-reaction idea that, with an unmerited favor done for someone else, they will be inspired to better their own life in some way, including but not limited to giving to others as they were given to. Can this happen in real life? Absolutely. Do we see it with any regularity? Doubtful. Is it something to be expected? Certainly not. Many people adopt a giving philosophy with expectations of what will happen when they give. And expectations are not always wrong. Think about it. If you give to an organization, you give with the expectation that they will fulfill their proposed (or already in-progress) mission. If you give to a school child, you give with the expectation that they (or their school) will accomplish a particular goal or perhaps receive a particular reward or standing. We tend to give to what we can see and expect. Even when, in the spirit of the ideology being addressed, we give to someone else with no idea how they may use our gift, it is frequently with the encouraging words, “Pay it forward!” We clearly communicate our expectation that they, too, will become followers of that philosophy which compels us to give.

If there were ever anyone who should expect to receive from what they have given, it is God. He gave us His Word with the intent that we might know Him, His plan, our need, and the resolution to our need. He gave all to us in the form of Jesus Christ, and He continues to give unceasingly and frequently, with no thanks or even notice from His creation. But in many Bible passages, He clearly warns us that giving is exactly that – frequently, thankless, and unnoticed. (Luke 6:31-35; Luke 14:12-14; Luke 17:12-18) We are not to expect an earthly reward for our gifts. We should be very careful, when giving, to GIVE our expectations over to God. He can take both our gifts (be it money, time, self, or whatever) and our expectations and fit them to His plan far better than our sin-plagued logic can.

So what, you may ask, is wrong with “giving back”? After all, everything we have is received as a gift from God, so are we wrong to work to give back? The giving back philosophy promoted by the world carries several distinct, rather insidious, perversions of Biblical truth. Giving back implies that what has been received can be restituted or paid back. The most glorious gift given, my salvation, is un-payback-able. Yeah, I know that’s not a word!

The world’s version of giving back directs our thoughts to how we can do for those who have done for us, and this is certainly not taboo. After all, am I saying that we should be ungrateful wretches who take and take, while others give and give? By NO stretch of the imagination! Gratefulness is something that must be nurtured and practiced every day, just as giving should be. However, there is a difference between gratitude and a debt. A brief example of something that we encounter with alarming frequency here in our country of service is as follows:

Someone helps us get our vehicle home after having it quit while on the road. We thank them profusely and express how much we appreciate their sacrifice in order to help us. They smile benevolently and say something to the effect of, “Yeah, well, you’ll do the same for me one day, too.”

The first time I heard these words, I was sure I had mis-heard. They could not mean that they were waiting to be repaid for the favor they had just done us, could they?! But this same scenario has been repeated in varying situations, but with the words practically verbatim, over and over in our 17+ years here. And yes, we have been frequently made aware of how we can/should give back to said benefactors. Do we begrudge helping these people? Not at all. We are glad to help! But the attitude that “what you give, you will surely receive” is, once again, a twisted version of God’s Word. Yes, we are told we will reap what we sow, and children need to understand that there are consequences to their actions. But whether we are talking about blessings or consequences, what we reap is in God’s hands. We don’t get to pick what we receive (what we think we deserve) based on what we give.

Luke 6:38 is very often invoked when we are speaking about giving and receiving. What we sometimes forget is that Luke 6:38 is the end of the sentence begun in verse 37 and the end of a much longer passage, clearly delineating how our God-mandated giving will likely be despised by others. Luke 6:38 is also immediately followed by verses reiterating that “The disciple is not above his master; but every one that is perfect shall be as his master.” Our Master was despised in every possible way and suffered unbelievably at the hands of those to whom He gave. Do we deserve or are we led to believe that we will be treated better? Simply put, no. Luke 6:38’s context leads me to the conclusion that the “good measure, pressed down, and shaken together, and running over, shall men give into your bosom” is still referring to that which God chooses to give us as a result of our giving. Daily, He uses men to bless others, but we should not see receiving such as our due.

Giving back is a concept that is not wrong in all situations, but we must be careful about over-emphasizing it to our children in the Biblical context of giving.

When you read The Giving Tree, The Rainbow Fish, and The Lion and the Mouse, you are confronted with varying degrees of the same wrong philosophies already mentioned above.

The Giving Tree seems as if it gives with no thought or expectation of return; but then there’s that one phrase. “And the tree was happy … but not really.” That one tiny phrase makes it clear that the tree’s giving came with conditions. The tree wanted to feel happy in return for its giving. Yes, I know we are all subject to emotions. Giving will involve and evoke emotions. But should we really teach our children that giving should assuredly bring happiness to our flesh? This is directly against what God teaches us in His Word. We are called to give, whether it produces endorphins or not. (This is another subject, but it is beneficial to study and be reminded of what true, Biblical happiness is and how we can have it.)

The Rainbow Fish gives all of his sparkly scales away so that he can have friends and be happy. Wait. What?? When you break it down that way, it sounds like it teaches that you can buy friendship. Well … it kind of does. The book tries to make it look altruistic, but the basic, erroneous teaching is once again that if you give, you will receive.

The Lion and the Mouse is another story of giving and receiving. As has already been stated, making children aware of being grateful and looking for ways to show that is NOT wrong. However, we must be careful how we teach it.

Did we have similar books for our children when they were small? Yup. We did. But we did not read and leave the books’ lessons for them to absorb at face value. Always set the Bible up as the filter through which everything must be evaluated. If applied consistently, your children will notice this and, prayerfully, apply it throughout their whole lives.

Giving Involves Much More Than Money or Things

I believe that for anyone to grasp what giving means, one must understand that giving is not only an action. I think most Christian parents are aware of the me-centric attitude of the world in which we live. This includes the idea that our children absolutely deserve to have MORE than we had – more things, yes, but also, more opportunities, more consideration, more choices, more … insert almost anything you like here. Unfortunately, this creates children who are assured (by the way the adults in their lives act) that they are the center of the universe. This perception contributes to a very rude awakening when some of these children reach adulthood and to a generation of people who are expectant receivers but inept givers. I’m sorry if that sounds harsh, but keep in mind that it’s not all their fault! As a result of their sin-nature, children are innately selfish, and a child is influenced and taught by everything to which he is exposed. Parents may not feel competent or comfortable being a school (or Sunday School) teacher; but despite this, they are the teachers most observed by their children. Attitudes and reactions are among the daily lessons given by parents, like it or not. And please, remember that a parent teaches both actively and passively. Without diminishing the active or spoken lesson (it is VERY important), its effectiveness is far inferior to the passive or silent lesson. Both must be in harmony in order for a child to effectively learn that which the parents desire.

So if giving isn’t only an action, let’s define what it is. While others may disagree or use different terms, my understanding of giving is that, at its root, it is an attitude. If you’re not sure where I’m going with this, let’s focus on the important question in my day-to-day living … How do I show a giving attitude to my children?

Do I shower them with attention?

Value their opinions?

Arrange my day and time around their desires?

Provide a variety of choices regarding those things that foster their mental and physical well-being?

Plan outings and activities to enrich them socially and mentally?

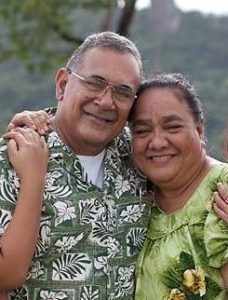

Allow me, for a moment to qualify the upcoming answers to the above questions. I will be speaking of Biblical principles taught to me by my mother, who raised me in God’s way without much spiritual participation from my father. He provided for and loved us fiercely, but was not committed to personal obedience to the Lord. We were, as a family, certainly not in full-time ministry. These same principles have been applied in my own family, by me and my husband Joel. We are full-time foreign missionaries. My personal illustrations will frequently reference our ministry and its importance in our lives. While I realize that not everyone reading this is in full-time ministry, if you want to teach your children Biblical giving, the answers are the same.

Answers ahead! In order, they are —— not necessarily, depends, rarely, sometimes, and maybe. If you hadn’t noticed, none of the questions have a cut-and-dried answer. Giving to my children and teaching them to give is complicated! To elaborate a little more …

Your children desperately NEED attention, albeit, the right kind. Do they demand your attention with bad behavior or lack of submission? Those things will manifest differently with each child; but that kind of behavior indicates an underlying problem, which I’ll address further under “What Biblical giving truly is.”

At all ages, your children are developing and forming opinions. As Christian parents, your responsibility is to help them form those opinions – not necessarily to give in to theirs. Our goal should always be for those opinions to be firmly based on the Word of God, because it can and should direct our opinions on even those things that seem insignificant. Encouraging your child to have and express an opinion is not wrong; but when your child is taught that his opinion is the most important or is the determining factor in a decision, he will only learn selfishness.

Without a doubt, I must spend time with my children. However, once again, their desires should not dictate my schedule for the day any more than they should dictate our family’s ministerial direction. (Please, note, I said “desires,” as opposed to “necessities,” such as health, emotional, or spiritual needs.) When young, they do not have the maturity to dictate anything; and when older, they still do not bear the responsibility before God for the direction of the family. Allowing my children’s desires to take the driver’s seat of my daily routine is shortsighted and detrimental to their understanding of how God leads us.

On the other side of the coin, my children’s mental and physical well-being should be a priority. However, in keeping with some other answers already given here, my children are not the best determinants of what they need. While it is not wrong to offer them appropriate choices, in our life and family, at least, other factors (financial, time, ministry, availability, etc.) hold far more weight than what they believe is best for their well-being. More on this under “What Biblical giving truly is.”

Family outings can be so special, and we’ve had some memorable ones! Here in Brazil, we’ve not gone to amusement parks or to exotic islands, but we’ve worked to make time for days and moments that contribute to our children’s growth and happiness. But even so, there have also been many times that we’ve had to, as a family, give up scheduled and much anticipated trips to a nearby city or to some activity, due to circumstances beyond our control or due to sudden and inescapable ministry needs. This is a prime opportunity to talk about giving – giving up your plans, your expectations, even your “rights” – when God diverts your path.

Giving Should Happen Every Day

So, back to how I can show a giving attitude to my children in day-to-day living. Here comes what may seem like a shocker to some … Giving is frequently inconvenient. Well, it IS! So teaching my children to deal with inconvenient things has been part of teaching them to give. Should we budget and plan to give? NO QUESTION – yes, we should. We should budget for giving, but what if a need arises that falls outside of the budget’s scope? I should plan my time so that giving is an integral part of my day, but what happens when that which someone or something needs, conflicts with my pre-established schedule? A few examples …

#1 — My mama taught me over and over to put others first, and certainly, that is giving. When I was little, it had to do with my daddy and with my friends. When we went to the grocery store to buy food, there was no, “Cynthia, what cereal would you like?” or “Pick out what Kool-aid you want.” We bought first and, frequently, only what Daddy wanted. No matter his spiritual state, he was the God-given leader of our home, and Mama taught me to respect and honor (give to) him every day. When he came home from work, Mama trained me to take off his boots. At first, it was hard, because I was little. Then I got the hang of it. We had many comical, laugh-inducing moments, when his boots stuck (or suddenly let loose) and I tumbled backward onto the floor! Giving was fun! Aaaaand, sometimes giving wasn’t as fun. Washing out his ash trays wasn’t at all my favorite thing to do; and while Mama never implied she approved of his smoking habit, she still made sure I knew that giving by doing such distasteful chores is sometimes part of life. And if I didn’t do it with the right attitude, Patch the Pirate songs like “Grumblers,” “Responsibility,” “Helpers,” and “A Tender Heart,” (among many others – all with the theme of giving!) convicted my not-cheerfully-giving heart.

When I had friends over to play, they got to pick first what we played, and if an argument or a spat arose, I was NEVER right. LOL! I laugh about it now, but at the time, I just knew Mama liked my friends more than me! But she didn’t. She loved me enough to NOT put me first but, rather, to show me how to put others first in my actions, in my attitude, in my words, and in giving up my “rights.” After all, we were playing at my house! It would seem to be my “right” to lead in what we played or my “right” to get a fair and just verdict in the event of an argument. But had my rights been preserved, I might not have learned as effectively how very sacrificially Jesus gave up His rights, when He provided for my salvation. Convenient? Shucks, no!

#2 — Over the years, we have had numerous conversations with our children about spiritual issues. Since lunch is the biggest meal in our part of the world, we rarely miss sitting down as a family to that meal. We have a wonderful opportunity here to talk with our children; and that table has witnessed many theological discussions, reproofs (what some would call an “intervention”), encouragements, and general teaching. But not all conversations happen during our planned family mealtime. In fact, some of the most significant have happened (and continue to happen) in the middle of the night. On more occasions than I can count, I have been woken up or been prevented from making it to bed at a decent hour (“decent,” by my habits, is 12:30 or 1:00) by a sobbing or distressed child/teenager. Sometimes it has been regarding salvation or assurance thereof. Sometimes it has had to do with something with which they are struggling mightily. When they were little, sometimes it was because of a bad dream. Always, it has been more important than my sleep or my comfort. That kind of interruption may be commonplace in your life, too; but our responses to those “little” things are part of teaching our children how to give.

Please, let me take this moment to clarify the following … my children have never been allowed to randomly interrupt my conversations with Joel or with another adult. We drilled and enforced very early on in their childhood, exactly what was and was not an acceptable interruption; and we clearly taught them that, when we were giving our time to speak with or listen to others, they should be respectful and giving, as well. In the early years, they didn’t always have the perception to adhere to said rules; so enforcement and then reenforcement (of varying severities, depending on the situation) were frequently applied.

#3 — Despite the changing landscape of our churches’ worship services, Sunday afternoons are as sacred as Sunday services in many households. Some people may nap; some may watch sports; pastors may study for the evening’s message or some other sermon; others may gear up and organize things for the many duties surrounding the worship service (music, choir, nursery, bus/van route, etc.). At the time of the incident I’m about to recount, our routine after Sunday School was to have family lunch, after which the kids could choose to nap, read, or do something else quietly so that I and Joel respectively could nap and study undisturbed for a brief time, before jumping into the pre-service race. The kids were used to this routine; Joel and I depended on this routine. On one particular Sunday, shortly after getting home from Sunday school, Joel received a call from a fringe church attender. The young mother of his two little girls had suddenly died; the little girls were spending the weekend at his house; and he was lost and despairing over how to tell them that their mama was gone. His wife was nearly as helpless as he. Afternoon routine discarded, Joel assured them that we would be there ASAP. Thankfully, although not accustomed to being left alone at the house, our children were old enough that, with strict instructions and a phone number by which to reach us, we could leave them for a brief period of time. They were wary of being left alone. To be honest, I was wary of leaving them. It was by no means convenient. But it was a situation of giving; and in our growing children’s limited understanding, they knew we had to go – to give.

#4 — “Inconvenienced” seems like a tame description for how Joel and I feel at having to cancel a planned outing — something that our children have so looked forward to! But despite our angst, we have had yet more opportunities to show them that God’s plans are not always ours. It is sobering to think of how many times I may have frustrated the way that God wants to give through me by refusing to be moved from what’s on my calendar. When we’re so focused on what we have scheduled that there’s no room for God to shake things up, we miss out on blessings that HE wants to give us or lessons that He wants to teach us outside of our plans.

#5 — Is it not inconvenient to be pulled or pushed from your comfort zone? I tense up the most when thinking about this, because it is a real struggle for me. But it is so necessary to teach this aspect to your children. I have one child who is and always has been a leader and a gifted communicator, while another is the strong, serving, silent type. Another is quiet with a servant’s heart. Yet another has an immense compassion for others and an obvious gift for organization. These are their strengths; and as we know, all strengths can become weaknesses, when they’re not yielded to God.

I remember my mama using the following phrase: “Die to self.” The words are simple, and the concept was not lost on me even in my childhood. But what does dying to self look like? Sometimes it has felt like my dying to self has been unfruitful or useless. In recent years, when trying to explain my natural personality (which is introverted in the extreme) to others, I have allowed annoyance to dominate me when I only get confused, even incredulous, smirking looks. The people to whom I’m speaking seem to not believe me when I explain how much I’d rather, in the flesh, not stand in front of anyone – how I quake internally with fear at the prospect of singing, leading, or organizing anything – how I’m really a behind-the-scenes girl with a STRONG preference for following. The Lord knows that all of those things are true; but with the teaching of my mama, the encouragement of many around me, and His infinite, perfect grace, He hides the real me and helps me do on a regular basis all of those things I’m not at all comfortable with. I still shudder to think of how badly I have done them; but I have been greatly humbled to realize that others not believing who I really am is a direct result of giving or dying to self. Dying to self doesn’t always look like we think it will, and this account is not given to glorify myself. I was honestly quite sinfully frustrated at the fact that people treated me like I was lying when I described my introverted self! It was in my frustration that the Lord lovingly took my hand and reminded me that my dying to self has not been fruitless and that He can still take the gift of my comfort zone and use it for His honor and glory.

It’s up to us as parents to help our children understand that giving involves following the Lord’s path no matter how far outside of their comfort zone or their natural strengths it leads. Just as examples in my children’s lives …

For my strong leader and gifted communicator, I encourage grace, along with the skill of listening and remembering what others communicate.

For my strong, serving, silent type, I encourage showing friendliness to others, along with clear verbalization of what this child believes should be abundantly clear with no words.

For the quiet one with the servant’s heart, I encourage no expectations of reward, along with a verbal openness (speaking up, respectfully and kindly) about their own needs with no diminishing of their service to others.

For my abundantly compassionate one with a gift for organization, I encourage discernment and understanding, along with an avoidance of comparisons or “policing” people even when others do not do things (or arrange things, or plan for things) exactly as this child believes it should be done.

Giving Is Practical

With no desire to “toot our own horn,” our children have seen practical instances of giving repeated in our family and throughout our ministry. Without a doubt, similar instances could be cited from many families and ministries around the world.

* Joel, jumping out of bed to head to the side of a distressed father whose son came home high on drugs … again

* Joel, racing off into the night to take a man and his pregnant wife to the local hospital; then with the man and his mother following the ambulance to another, more distant city where the birth would actually take place; getting back around dawn only to head right back a few hours later with me and items needed for the new mama and baby

* as a family, leaving the mid-week evening service late to head to comfort a woman and her family (once a faithful part of our ministry, then “backslidden”) whose father unexpectedly passed away. The kids saw that giving sometimes means sitting in the car and waiting quietly, even when they’re tired and hungry; and sometimes, when you’re prepared to give in that particular way and the family finds out, they insist you come inside anyway.

* as a family and as a church, gathering clothes and food for a specific need in our own city or in one nearby

* our young children, giving of their treasured toys to the church nursery/kids area and periodically sharing other toys in order to make various and sundry church activities more enjoyable for those involved

* Joel, giving to me in myriad ways and teaching our kids to give and help me around the house, when I’ve had injuries or sicknesses that prevent normal activities. This translates, now, to our children jumping in to give to each other, also, when one is sick. They work to see where they can step in to cover chores that the sick sibling cannot do, and they (to varying degrees, as each one has a different personality) hover around the sickling to see what they can do to alleviate their pain.

* our now-older children, surprising their siblings with random gifts (maybe an iTunes album or a pan of brownies)

* our children, now, cleaning and preparing the bathrooms and the gathering areas for each church service. They are also regularly involved in various ministries, where they continue to learn how to give and serve.

* as a family unit (when the kids were young) and, now, we and each child individually, giving to missions via our home church

There are so many other day-to-day moments of giving that could be cited, but I feel as if I’m bragging when recounting these things. That’s surely not my intention! The crux of the matter is how such instances are presented to your children. Do you portray it as an inconvenience or a chance to give? We have not been perfect at teaching giving, but what our kids have seen illustrated is that giving happens in practical ways, every day, right alongside the ministry to which God has called us. We have worked — frequently, struggled — to exemplify what we teach our people here in Brazil – that God, in no way, endorses choosing ministry over family or family over ministry. Rather, those two things should walk hand in hand – family in the ministry, and ministry in the family. We should be giving and giving-in to the Lord in every aspect of our lives.

Make a habit of drawing your children’s attention to giving.

My mama tells the story of when I was 4 or 5, me pestering her repeatedly to send 25 cents, that I had set aside, to The Bill Rice Ranch ministries. She fought the urge to refuse to send such a small amount, instead determining that she would not suppress my desire to give. So she sent it with a brief explanation that it was from her small daughter and that even though it was not much, her daughter hoped that they could use it in the Lord’s work. She got a sweet note back from one of the Rice ladies thanking her and saying, “Little is much, when God is in it.” What a wonderful encouragement that was to her heart and in my young life!

While in a missions conference during our deputation, we were blessed by a very young man who not only hung out with us, picked our brains, and played with our kids every night, but also one night presented Joel with an envelope. Joel thanked the young man profusely while tucking the envelope into his breast pocket. Later, we found what was a fairly large sum for a young person of his age to give. His parents quietly informed us that he had worked all summer to save the money in that envelope. We were floored, but grateful, and prayerfully watched that family and that young man as he grew. His parents were (are) givers; and although it wasn’t done for everyone to see, it was impossible to miss them teaching that and other godly principles to their children. As we have sought for our own children to learn a giving spirit, the young man and his gift have been frequently brought to their attention. That giving young man is now a missionary on a tiny South Pacific island, where he gives far more than money each and every day.

Another instance that I was thankful to be able to point out to my children (especially my daughters) was a young lady who, throughout missions conferences, served unobtrusively in any way needed. I watched her minister in the services, kindly engage others around her (children and adults alike) in conversation, and move from table to table after meals asking if she could remove the diners’ trash and utensils. Nothing was “beneath” her; she was beautiful inside and out, and I gratefully pointed her out to my children as a godly example of service and giving. She is a mama now and, from what I can see, is still being beautifully used by the Lord in her family and her ministry. Giving can and should be life-long.

If your children express interest in giving or serving, wisely foster that. Don’t pat them on the head and say, “Don’t worry about that. Mom and Dad, for our family, already give to missions,” or “We already serve in ________ ministry.” Help them see where they can serve and even join them in it, whether it be simply welcoming visitors, assisting in a children’s class, or ministering in a nursing home. There are so many ways a child can give and serve! Also, help them look at any money they receive not as theirs, but as money God has given them to use within His plan. Yes, they need to learn good financial management. Please teach it … because good, godly financial management should always include Biblical giving, no matter one’s age.

What Biblical Giving Truly Is

A couple of times in our ministry here, we and our ladies’ group have organized a visit to the local orphanage. The desire has been, of course, to have a chance to reach their hearts and minds for Christ even for just a day, while playing with, feeding, and giving to these children. The hopelessness in those young eyes is something seen world-wide in similar situations. One thing that was hard for me, the first time we went, was being confronted with the government workers in the orphanage who are exactly as described earlier: expectant receivers and inept givers. They virtually demanded that we give the same items to them, for their children at home, that we gave to the orphans in the institution. Any hesitation on our part (mostly because we had not prepared enough to give to others besides the orphans) was met with hostile looks and snide comments such as, “And you call yourself a Christian?!” or “I have children at home who like sweets and snacks, too, you know?!” It was supremely hard to respond correctly to those capable adults who expected us to give to THEM rather than the orphaned children. We didn’t go there for those adults! They weren’t the intended recipients of our physical gifts!

But over the years, as the scene that day sometimes plays on repeat in my head, God has helped bring my attention to how the unworthy request made by those adults falls far short of my own unworthiness before Him. Many, many times I need to be reminded that I’m not only to give to those I deem “worthy” but to anyone the Lord deems worthy. Does this mean that I hand out coins to the drunk who trolls the grocery store parking lot? Or the children who tragically, yet unabashedly, declare that they’re looking for glue to sniff? No. But we have, on more than one occasion, paid for a meal or a hotel room for someone who we’ve never met before. We know that, here where we serve, it is unwise to give cash to any random beggar; but depending on the situation, sometimes we can still give in other ways. Those people may or may not really need what they’re asking for; but since I’m not God, I don’t always get to know that. What I do know is that God has given, to unworthy me, far more than I can possibly even comprehend. If I am defrauded or conned by someone else unworthily, He can take care of it; but if I miss giving to someone He’s placed in my path for that purpose, I’ve dealt a blow to the cause of Christ, causing Him and myself great shame. These situations (such as the orphanage workers) can be aptly used to teach my children how to love and give, even when others are not “worthy”of receiving. Jesus’ example proves that this is certainly Biblical.

Now, as promised, revisiting the question regarding giving your children attention …

The attention a child needs is based on many factors and may be used to inspire giving in a number of ways; but one thing is universally true. If you’re giving the wrong kind of attention and are not teaching your child unconditional submission to God and to you, his parents, you’re not teaching him giving. He does not always need an answer to “Why?” If you’re thinking, “Seriously?! Come on!” please understand that I am not saying that it is always wrong to answer your children’s honest questions. It is wrong to answer, if the child believes that his right to an answer supersedes his responsibility to obey. Teaching my children anything short of immediate obedience would have been doing them a disservice. After all, does God always answer our “Why?” Of course not. Are we, then, excused from submitting to Him simply because we didn’t get our question answered to our satisfaction? Honest questions may be asked and, even then, only sometimes answered after “giving in” is taught. When my will is not submitted to God, my giving is greatly impeded and can even go so far as to be dishonoring to Him. Teaching a child simple, unquestioning obedience (while being ready, as parents, to respond to their questions later) is absolutely KEY to them understanding Biblical giving.

Please understand as well that answering a child’s question as a direct reward for obedience, or dangling any other kind of “carrot” before them, points them to the unBiblical idea that their giving (or giving-in) is logically followed by receipt of something they desire. This is, once again, giving them the wrong impression of how God works in our lives. God is the Creator, the Giver of life, the Master of all things. He deserves my obedience with no thought of recompense and no strings attached. The world will not teach our children this, and Satan is gleefully content with a generation of people who are disgruntled with God because He doesn’t fit their idea of “fair.”

I also promised to revisit the issue of a child’s well-being in relation to giving. So, here goes … Life is full of giving – you can give cheerfully or, well, not cheerfully. But, once they reach adulthood, our children will be forced to give – give money to the government, give time to a job, give dedication to a ministry, give up something they WANT in favor of what is actually available, etc., etc. We don’t have to agree with all the ways we are forced to give; but if our children grow up resentful of giving and view it instead as thievery, how will they view God when He asks them to give? Giving, in one form or another, is a part of life; and it’s my responsibility to prepare my children for choosing “being godly and well” over the world’s view of “well-being,” wherever God calls them and within the constraints of the authorities He places over them.

Joel and I have faced some interesting perspectives, comments, and questions regarding our (and, now, our children’s) giving tithe and faith promise via our home church. Some people deem it unnecessary; some are taken-aback; some believe that we already “give enough” by being on a foreign field. The opinions are varied and are, almost always, shared with the greatest care and love for us. We appreciate the kindness and wisdom offered; but a couple of things guide us, above all. First, God makes it clear that the tithe is His. We don’t give that in the classic sense of the word; we simply obey and put that amount where we believe His Word directs us to – in the hands of His church, the local church, our home church. Second, regarding faith promise, along with the Biblical examples that are clearly pro-missions-giving, we WANT to give. I counsel you strongly … don’t rob yourself or your children of the joy of giving just because you ARE the missionaries on the field or you ARE the pastor and his family or you ARE the itinerant evangelist. Work to breed thankfulness in your children for those who have sacrificed to give to you AND a desire to be part of the sacrifice it takes to send others.

As a result of the sometimes twisted giving philosophies discussed earlier, our society has seen a huge uptick in the availability of ways to give. People used to go door-to-door. Then, personal calls (you know, where it’s an actual person on the other end of the phone) were made by organizations seeking donations. TV commercials, program slots, and give-a-thons eventually became the new medium for reaching potential givers. In the same time-frame, automated calling (soon followed by robo calling) was employed. Now, of course, you can find any number of web sites – some well-known, others less so – and even the ubiquitous “Donate” buttons dedicated to the collecting of funds from willing contributors.

Are these things wrong? Not always, no. I don’t believe they are wrong, because like any other tool we are given, their rightness or wrongness is based on how they are utilized. Remembering that we are talking about cash donations (very few ways to creatively help out someone in need online), a few questions that I use to determine whether I’m making a right choice or not are as follows:

1. Is the person to whom, or the cause to which, I’m giving upholding Biblical truth? No matter my sympathy for a particular person or situation, I must remember that the Bible is to be the lens through which I evaluate everything.

2. Am I giving with a Biblical attitude and expectations? We’ve already talked about this, right?

3. Have I already given, as God clearly teaches I should, via my local church – first the tithe and then offerings? The tithe is already God’s. We just get the privilege of obediently putting it back in His hands via the local church. And Paul, inspired by God, writes and teaches extensively on giving through the local church to missions. Our giving to other causes should never interfere with that which God has called us to give via our local church.

If the answer to all of these questions is “yes,” then it is time to seek God’s face and follow Him only, as to whether or not (and how much) to give. The reason I ask those questions even before praying is because God’s Word makes no bones about certain aspects of giving. If the person or project in question ticks the boxes of those three questions, then it might be honoring to God if I gave. Giving the way God wants us to is clear cut in some situations. In others, it requires great wisdom and discernment, which we can only get from HIM.

One of my favorite Bible stories of giving is the widow and her two mites. Several things stand out to me in this snippet from Jesus’ ministry recounted in two of the gospels.

One, the widow did not compare herself with others. Jesus did the comparing. We must remember that our giving should not be compared with anyone or anything else. Let God’s calculator – one we cannot see – be the only one that matters.

Two, Jesus did not condemn the rich that cast in much. I’ve heard this story referenced as almost a defense of the idea that poor people are more precious to God than those who have a larger bank account. This was not what Jesus was teaching. Yes, He was challenging those who might have looked down on the poor widow, but it was not strictly because of her poverty. It was because of her sacrifice. On the other side of the coin, I have known servants of God who appear rich in this world but who make immense sacrifices so that they always have funds available for Biblical giving. May my sacrifice be pleasing to Him, whether it looks big or small to others.

Three, it seems apparent that long before this widow cast in her two mites, she had cast in much more – things such as those referenced earlier – time, plans, rights, comfort zone, etc. She gave with her money, but that gift makes it clear that her life, in general, was already cast in.

Teaching these principles to our children has never been more relevant than it is now; and as in so many areas, if we’re not teaching them, someone else will. Let’s make sure our children have the foundation for life that pleases the Lord in all aspects, including giving! There is no exhaustive and fail-proof list of ideas to teach children in order to make them “giving.” Rather, it is a constant attitude, a consistent application, and a cast-in life. May our giving reflect our Savior!

Several Generations of Giving Testimonies

My mama wants others to know that GOD’S WAY IS NOT HARD. She almost constantly receives kind comments from others about how hard it must be for her to have her only child (and only son-in-law and grandchildren) on the mission field so far away. She practices exactly what she taught me – submission in giving. While some others may not understand, submission to the Lord brings happiness from the Lord. It may not qualify as happiness in the world’s eyes, but so many Biblical truths don’t “make sense” to the world or our flesh. (Again, understanding what happiness really is can be so helpful to one’s Christian walk!) I believe Mama would say that missing someone does not mean that it is hard to give them over to God. She has repeated, over and over (as so many missionary parents/family have), “God’s will is the safest place you could be, and that’s exactly where I want you. Never step outside of it.”

We have been through many financial ups and downs here on the mission field. I could tell story after story of how God has graciously provided for our needs and even for our wants, at times. He is so good to us, even though we aren’t worthy of it! Despite having lost 40-50% of our buying power for an extended time during our first term, we have never had to diminish our faith promise via our home church. That is God. We are only the channel.

Our children’s remembrances of what prompted them to give …

Daniella remembers that we always taught her about giving. She was first personally touched for giving by a flood in West Virgina and some little girls she heard about whose toys were destroyed after their basement flooded. She came to us with ideas about giving to those little girls. Later, she was touched to give via faith promise in our home church’s mission conference.

Aydan says that, at first, he made a faith promise in order to do something “adult.” Then, he began to realize that it was something between God and him and was promoting the gospel around the world. After Aydan and I talked about his memories of learning giving, he sidled back up to me, hiding a smile behind these words, “And, well, it brings a certain amount of joy to give.” I could not hide my smile as I heartily agreed with him.

Abigail said, “I knew that God wanted me to give for His sake. Really, I knew that God wants me to give, and I want to do what HE wants.”

Morgan says that during missions conference at our home church when he was young, he related what he was hearing from the missionaries there to what he knew our family goes through here on the field. He was a little uncomfortable at first with the thought of the money he gave coming back, even in a small way, to his own family. But after praying about it, God made it clear that God could take his money and use it according to His plan. He says, “It is not a chore, but it is a duty. God deserves my giving.”

Cynthia Dickens and her husband Joel serve in Brazil with their four children. If this article has been a blessing to you, let Mrs. Dickens know here.