Faith is not just about what we believe—it’s about how we live. As you work through these devotionals, my prayer is that you will grow stronger, stand firmer, and live bolder for Christ. No matter what comes, you can remain unshaken because your foundation is in Him. – John O’Malley

Faith is not just about what we believe—it’s about how we live. As you work through these devotionals, my prayer is that you will grow stronger, stand firmer, and live bolder for Christ. No matter what comes, you can remain unshaken because your foundation is in Him. – John O’Malley

Below is an excerpt from Bro. John O’Malley’s book, Unshaken: Strengthening Your Faith. If you would like to read the book in its entirety, please click here.

1 Corinthians 5:1-5

“It is reported commonly that there is fornication among you, and such fornication as is not so much as named among the Gentiles, that one should have his father’s wife. And ye are puffed up, and have not rather mourned, that he that hath done this deed might be taken away from among you. For I verily, as absent in body, but present in spirit, have judged already, as though I were present, concerning him that hath so done this deed, In the name of our Lord Jesus Christ, when ye are gathered together, and my spirit, with the power of our Lord Jesus Christ, To deliver such an one unto Satan for the destruction of the flesh, that the spirit may be saved in the day of the Lord Jesus.”

Learn About It

Paul rebukes the Corinthian church for tolerating open sin within their congregation. A man was involved in an immoral relationship with his stepmother—a sin that even the pagan Gentiles found shocking. Yet, instead of dealing with the issue, the church was “puffed up”—arrogantly ignoring the sin rather than mourning over it.

Paul makes it clear that sin left unaddressed will corrupt the entire church. He commands them to remove the man from their fellowship, not out of cruelty, but out of love for his soul. The phrase “deliver such an one unto Satan” means allowing the man to face the consequences of his sin outside the protection of the church, with the hope that he would repent and be restored.

This passage reminds us that sin in the church is never just a personal matter—it affects the whole body of believers. If tolerated, it spreads like yeast in dough, corrupting others and damaging the church’s testimony.

Apply It to Me

Today, many churches struggle with compromising on sin for the sake of avoiding conflict or appearing “loving.” But true love confronts sin with truth and grace, seeking repentance and restoration.

• Do I excuse or overlook sin rather than addressing it biblically?

• Am I more concerned with appearing tolerant than with upholding holiness?

• Do I hold myself accountable to living righteously, or do I justify my own compromises?

Paul’s warning is clear: tolerating sin weakens the church. We must hold each other accountable in love, seeking to restore those who fall, while maintaining holiness before God.

Talk to God About It

Lord, help me to take sin seriously. Give me the courage to address it in my own life and to lovingly encourage holiness in my church. Keep me from becoming indifferent to unrighteousness. Let me balance truth with grace, always seeking restoration rather than condemnation. In Jesus’ name, Amen.

Act on It

Examine your own heart for any sin you have ignored or justified. Confess it before God and take steps toward repentance. If someone in your church is struggling, pray for them and, if appropriate, encourage them toward restoration in Christ.

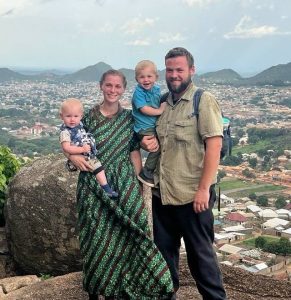

John O’Malley

If this article has been an encouragement to you, you can email Bro. O’Malley to let him know.