Click the link above to download a PDF of our current World Wide Family. Note: You will need to login to SecureCloud in order to view this document. Once you have logged in, click on Files Shared, then Headquarter Happenings, then scroll to the month you would like to view. This step protects people with WWNTBM in restricted access fields.

Tax Time Reminders

Tax season is once again upon us! Following are several reminders for our missionaries concerning tax issues that you may face. We trust that this information will be useful to you both in giving you a better understanding of your reports and helping you to be aware of items that may affect your personal taxes. Please be sure that you are following published guidelines when listing expenses on your financial reports. Thank you!

Tax season is once again upon us! Following are several reminders for our missionaries concerning tax issues that you may face. We trust that this information will be useful to you both in giving you a better understanding of your reports and helping you to be aware of items that may affect your personal taxes. Please be sure that you are following published guidelines when listing expenses on your financial reports. Thank you!

The Affordable Care Act and Your Taxes

This is the first year that the Affordable Care Act will affect your taxes in regards to your Health Insurance coverage. If you are enrolled in the Health Insurance Marketplace, you should expect to receive a Form 1095-A from the Marketplace, which you will need to submit to your tax preparer. If you were not enrolled in the Marketplace, you may still need to discuss your Health Insurance plan with your preparer, as it is our understanding this will affect your tax return this year. Questions about this should be directed to your tax preparer.

Estimated Tax Payments

Missionaries are considered to be self-employed, and are therefore subject to self-employment taxes. Submitting quarterly estimated tax payments throughout the year will help to prevent having a large tax payment due each April. Estimated tax payments can be submitted on your own, or, if you are interested, you may contact our office for information on how we can submit them for you.

1099 Forms

If churches issued funds payable to you in excess of $600 during the year 2014, they may issue you a 1099 form. If those funds were either mailed to the office, or included on Line 2 of your MFR as extra income, they are already included in the total of your W-2. Our office can assist you in verifying if the funds were included on your W-2. Your tax preparer can assist you on your return in recording this so that you are not taxed twice on the same income.

Foreign Tax Exclusion

In order to claim the foreign tax exclusion, you must be out of the US for 330 days over a 12 month period of time; however, these days do not have to be in the same calendar year. In order to gain the full benefit of the foreign tax exclusion, your tax preparer may be able to revise your returns based on the actual time you have spent overseas. Because of this, it is vital to provide your tax preparer with all of your travel dates to and from the US. You may also wish to discuss with your tax preparer what dates would be the best travel dates when planning to leave for the field or return on furlough, as this could affect how much you are allowed to claim under the foreign tax exclusion.

Ministry Bank Accounts

If your ministry has been chartered and established as a non-profit organization, we recommend having your ministry get a bank account in its name. Funds for purchases such as land may be able to be sent directly to your ministry, thus eliminating your personal tax liability. Please note that there are limitations to this option. Of course, regular support could never be sent this way. Please contact our office for more information.

Tax Paperwork for those with Foreign Bank Accounts

US Treasury Dept. regulations require that if you have any foreign bank accounts, and if the sum total of all of your foreign accounts has ever been $10,000 at any given time during the past year, you must complete the IRS Form TD-F90-22.1, and give it to your tax preparer. This form, and further information about it, is available on the IRS website at www.irs.gov. It is our understanding that there have been several changes to these requirements in recent years, and you may also need to complete the new Form 8938. Please refer to the IRS website and your tax preparer if you have any questions.

The True Cost of Doing Your Own Taxes

Studies have shown that the average person who uses a tax professional, instead of filing their own taxes, receives a much greater tax return. When comparing the returns of those who self file vs. those who use a tax professional, it is estimated that a self-filer loses between $297 and $791 in missed refunds. The savings far exceed the amount spent to hire a professional. (Statistics taken from daveramsey.com.) We strongly recommend that all missionaries use a certified tax preparer who is familiar with special tax situations that affect missionaries. Contact the Office for a listing of tax preparers used by other missionaries.

Ministry Milestones 2014

We would like to recognize several ministry milestones that were reached during the year 2014. We are grateful for these individuals who continue to serve faithfully.

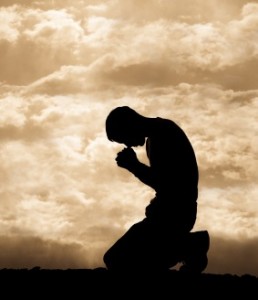

Poem: Traveling on My Knees by Sandra Goodwin

Last night I took a journey

Last night I took a journey

To a land across the seas;

I did not go by boat or plane,

I traveled on my knees.

I saw so many people there

In deepest depths of sin,

But Jesus told me I should go,

That there were souls to win.

But I said, “Lord, I cannot go

And work with such as these.”

He answered quickly, “Yes, you can,

By traveling on your knees.”

He said, “You pray; I’ll meet the need,

You call and I will hear;

Be concerned about lost souls,

Of those both far and near.”

And so I tried it, knelt in prayer,

Gave up some hours of ease;

I felt the Lord right by my side,

While traveling on my knees.

As I prayed on I saw souls saved

And twisted bodies healed,

And saw God’s workers strength renew

While laboring on the field.

I said, “Yes, Lord, I have a job,

My will Thy will to please;

So I can go and heed Thy call,

By traveling on my knees.”

Missionary Scrapbook: Missionary Kids

Click on the link above to download a PDF of pictures of some of our missionary kids. Note: You will need to login in to SecureCloud in order to view this document. This step protects people with WWNTBM in restricted access fields.